National Debt Relief Review 2025: The Unbiased Truth for Consumers

Facing overwhelming debt can feel like you're navigating a storm without a compass. When monthly payments become unmanageable, companies like National Debt Relief (NDR) emerge as a potential lifeline. This comprehensive review of National Debt Relief is designed to give you a clear, unbiased look at their program, helping you understand if it's the right solution for your financial situation. We'll break down the process, the significant risks, the potential rewards, and how it stacks up against other options.

Debt settlement is a serious financial decision with long-term consequences. It's not a magic wand that makes debt disappear without a trace. Instead, it's a strategic negotiation process that can reduce what you owe but often comes at the cost of your credit score. This analysis will equip you with the facts you need to make an informed choice.

What to Know

- Legitimacy and Risk: National Debt Relief is a legitimate, accredited debt settlement company. However, the process is inherently risky and involves stopping payments to creditors, which severely damages your credit score.

- Best-Fit Candidate: The program is designed for individuals with over $7,500 in unsecured debt (like credit cards or personal loans) who are already struggling to make minimum payments and are facing financial hardship.

- Cost Structure: NDR charges a fee of 15% to 25% of the total debt you enroll. This fee is only paid after a debt is successfully settled, meaning there are no upfront costs.

- Credit Impact: Expect your credit score to drop significantly during the program, which typically lasts 24 to 48 months. The negative marks can stay on your credit report for up to seven years.

- Alternatives Exist: Debt settlement isn't the only option. Non-profit credit counseling, debt consolidation loans, and, in extreme cases, bankruptcy are other paths to consider, each with its own set of pros and cons.

What is National Debt Relief and How Does It Work?

National Debt Relief is one of the largest and most well-known debt settlement companies in the United States. It's crucial to understand that NDR is not a lender providing a consolidation loan, nor is it a non-profit credit counseling agency. It is a for-profit company that specializes in negotiating with your creditors to accept a lower payoff amount than what you originally owed.

The core of their service is debt negotiation. They work on behalf of consumers who are buried in unsecured debt—this includes credit card balances, medical bills, personal loans, and other debts not tied to an asset like a house or car. They do not handle secured debts (like mortgages or auto loans) or federal student loans.

The process begins when you stop making payments to your creditors and instead deposit a fixed monthly amount into a dedicated, FDIC-insured savings account that you control. As the funds in this account grow, NDR's negotiators contact your creditors to make settlement offers. Once a creditor agrees to a settlement and you approve it, NDR uses the funds from your savings account to pay the creditor and then collects its fee for that specific debt.

A Deep Dive into the National Debt Relief Process: A Step-by-Step Guide

Understanding the journey from enrollment to debt freedom is key to setting realistic expectations. The process is a marathon, not a sprint, typically taking between two to four years to complete. Here’s a breakdown of what you can expect at each stage.

Step 1: The Initial Consultation and Eligibility Check

Your first interaction with NDR is a free, no-obligation consultation with a debt specialist. During this call, you'll discuss your financial situation, including your income, expenses, and total debt amount. The specialist will determine if you're a good candidate for the program, which generally requires having at least $7,500 in qualifying unsecured debt and experiencing some form of financial hardship that makes it difficult to keep up with payments.

Step 2: Enrolling and Setting Up Your Dedicated Savings Account

If you decide to move forward, you'll enroll in the program and set up your dedicated savings account. This is where you'll make your single monthly program payment. This step is critical: you must stop paying your creditors directly. This action is what gives NDR the leverage to negotiate, as creditors may prefer to receive a partial payment rather than risk getting nothing if you were to declare bankruptcy.

Step 3: The Negotiation Phase

Once you've accumulated enough funds in your savings account (usually after a few months), NDR's team begins the negotiation process. They will reach out to your creditors one by one to negotiate a settlement. Their goal is to get the creditor to agree to accept a lump-sum payment that is significantly less than your current balance. This phase requires patience, as negotiations can take time and not all creditors are willing to settle quickly.

Step 4: Settlement and Payment

When a settlement is reached with a creditor, NDR will contact you for approval. You have the final say on every settlement offer. Once you approve, the funds are transferred from your dedicated account to the creditor. After the payment is successfully processed, NDR will collect its fee for that settled account, which is a percentage of the enrolled debt amount.

Step 5: Program Completion

This process repeats for each of your enrolled debts until all have been settled. Upon settling the final account, you graduate from the program. At this point, you will be free from the enrolled debts, though the impact on your credit report will remain for several years. The next step is to begin the process of rebuilding your credit history.

The Pros and Cons of National Debt Relief: A Balanced Analysis

No debt relief solution is perfect, and debt settlement is a path filled with significant trade-offs. A thorough national debt relief analysis requires looking at both the potential benefits and the serious drawbacks. Weighing these factors carefully is essential before making a commitment.

The Advantages of Using National Debt Relief

- Pay Less Than You Owe: The primary benefit is the potential to resolve your debt for a fraction of the original amount. Successful clients often see their total debt reduced significantly, even after accounting for NDR's fees.

- Simplified Payments: Instead of juggling multiple payments to different creditors, you make one consistent monthly payment into your savings account, which can simplify your budget and make your financial life feel more manageable.

- Expert Negotiation: You get access to a team of experienced negotiators who have established relationships with many major creditors. They handle the stressful communications and negotiations on your behalf.

- No Upfront Fees: NDR operates on a performance-based model. They don't charge any fees until they've successfully negotiated a debt and you've approved the settlement. This aligns their success with yours.

- Industry Accreditations: The company holds accreditations from the American Association for Debt Resolution (AADR) and the International Association of Professional Debt Arbitrators (IAPDA), and it has a high rating with the Better Business Bureau, which adds a layer of legitimacy.

The Significant Downsides and Risks

- Severe Credit Damage: This is the biggest drawback. Because you must stop paying your creditors, your accounts will become delinquent. This will cause your credit score to plummet, and the negative marks (late payments, charge-offs, settled accounts) will stay on your report for up to seven years.

- No Guarantee of Success: Creditors are under no legal obligation to negotiate with National Debt Relief. While NDR has a strong track record, there's always a chance a creditor could refuse to settle.

- Risk of Lawsuits: When you stop paying your bills, creditors may escalate their collection efforts, which can include filing a lawsuit against you. While this doesn't happen to every client, it is a real and serious risk.

- High Fees: The fees, ranging from 15% to 25% of the enrolled debt, can be substantial. For example, on $30,000 of debt, a 20% fee would amount to $6,000.

- Potential Tax Consequences: The IRS may consider forgiven debt of $600 or more as taxable income. You could receive a 1099-C form and owe taxes on the amount that was forgiven, which can be an unexpected financial hit.

Who is Eligible for National Debt Relief?

National Debt Relief doesn't accept everyone into its program. The company has specific criteria to ensure that clients are in a position where debt settlement is a viable, albeit difficult, option. Understanding these eligibility requirements is the first step in determining if this path is even open to you.

First and foremost, there is a minimum debt requirement. You must have at least $7,500 in total unsecured debt to qualify. This ensures the program is reserved for those facing a substantial debt burden where negotiation can have a meaningful impact. If your debt is below this threshold, other methods like personal budgeting or a small consolidation loan might be more appropriate.

Second, you must be able to demonstrate financial hardship. This is a key component. Debt settlement is designed for individuals who, due to circumstances like a job loss, medical emergency, or reduction in income, can no longer afford their minimum payments. If you can comfortably afford your payments, you likely won't qualify, as creditors would have no incentive to settle.

Finally, the program is only for specific types of debt. It focuses exclusively on unsecured debt, such as credit cards, medical bills, and unsecured personal loans. Secured debts, like mortgages and car loans, are not eligible because they are backed by collateral. Federal student loans and certain other government-backed debts are also excluded from the program.

The Unavoidable Impact on Your Credit Score

One of the most critical aspects to understand in any national debt relief review is the program's effect on your credit. To be blunt: enrolling in a debt settlement program will have a severe, negative impact on your credit score. There is no way around this, as the very mechanics of the process work against the factors that build a good credit score.

Your credit score is heavily influenced by your payment history, which accounts for about 35% of your FICO score. The debt settlement process requires you to stop making payments to your creditors. This means your accounts will be marked as delinquent, with late payments reported for 30, 60, 90 days, and beyond. These missed payments are one of the most damaging events for a credit score.

As the accounts remain unpaid, creditors will eventually "charge them off," which means they declare the debt as a loss. A charge-off is another major negative event on your credit report. When a debt is finally settled, the account will be updated to show "settled for less than the full amount." While this is better than an unpaid charge-off, it's still considered a negative entry by lenders. The combination of these factors can cause your score to drop by 100 points or more.

This damage isn't temporary; these negative marks will remain on your credit report for up to seven years.

After completing the program, you can begin to rebuild your credit, but it's a slow process. You can monitor your progress and get tips for recovery using free services like Credit Karma or Credit Sesame. These tools can help you track your score's recovery and understand the steps needed to re-establish a positive credit history.

National Debt Relief vs. The Alternatives: A Comparative Analysis

Debt settlement is just one tool in the financial toolbox for handling overwhelming debt. It's crucial to compare it against other available options to determine the best fit for your unique circumstances. Each path has different costs, credit impacts, and timelines.

| Strategy | How It Works | Impact on Credit | Best For |

|---|---|---|---|

| Debt Settlement (NDR) | Negotiate with creditors to pay less than the full amount owed. | Severe negative impact. | Those with major hardship who can't make minimum payments. |

| Credit Counseling (DMP) | A non-profit agency works with creditors to lower interest rates. You repay 100% of the debt. | Minimal to neutral impact. Can improve score over time. | Those who can afford monthly payments but struggle with high interest. |

| Debt Consolidation Loan | Take out a new, lower-interest loan to pay off all existing debts. | Can be positive if you make payments on time. | Those with a good enough credit score to qualify for a new loan. |

| Bankruptcy (Chapter 7/13) | A legal process to eliminate or restructure debts under court protection. | Most severe negative impact, lasts 7-10 years. | Those with no other viable options to resolve their debt. |

Debt Settlement vs. Other Debt Settlement Companies

Within the debt settlement industry, National Debt Relief is a major player, but not the only one. Companies like Accredited Debt Relief and Beyond Finance offer similar services. When comparing, look at their fee structures, minimum debt requirements, customer reviews, and accreditations. It's always wise to get consultations from a few different companies before making a decision.

Debt Settlement vs. Credit Counseling

Non-profit credit counseling agencies offer Debt Management Plans (DMPs). With a DMP, you still make a single monthly payment, but the agency distributes it to your creditors. The goal is to repay your debt in full over 3-5 years, but with lower interest rates. This option is far less damaging to your credit score and is an excellent alternative if you can still afford your monthly payments but are being crushed by interest charges.

Debt Settlement vs. Debt Consolidation Loans

If your credit is still in fair or good shape, a debt consolidation loan could be a great option. You take out one new loan to pay off all your high-interest credit cards and other debts. This leaves you with a single, fixed monthly payment, often at a much lower interest rate. You can explore loan options through services like the Round Sky Debt Consolidation Affiliate Program.

The key challenge is qualifying for a loan with favorable terms when you're already in debt.

Pro Tip: A debt consolidation loan only works if you stop accumulating new debt. After consolidating, it's critical to create a budget and change the spending habits that led to the debt in the first place.

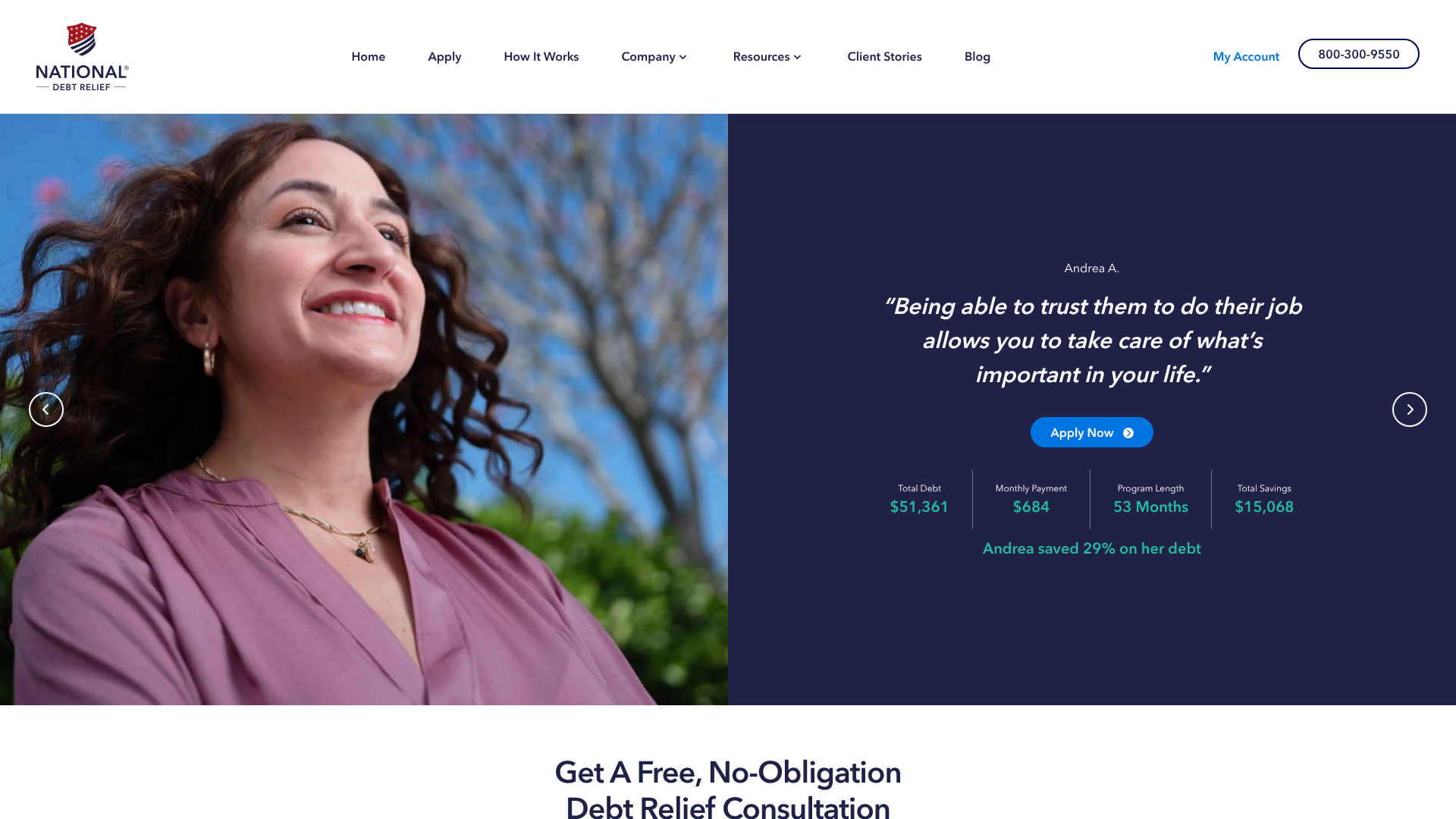

Real Consumer Testimonials and Case Studies: What Are Customers Saying?

Online debt relief reviews paint a complex picture of National Debt Relief. The company has thousands of positive reviews on platforms like Trustpilot and the Better Business Bureau, but there are also a significant number of complaints that highlight the inherent risks of the process.

Positive reviews frequently praise the company's customer service representatives, describing them as helpful, professional, and empathetic. Many successful clients report saving thousands of dollars and express immense relief at finally being debt-free. These testimonials often come from individuals who felt they had no other way out and found the program to be a successful last resort before bankruptcy.

However, negative reviews and complaints tell a different story. A common theme is that the damage to their credit score was more severe or happened faster than they anticipated. Other customers express frustration with the length of the program or the fact that they were sued by a creditor while enrolled. As one user on a Reddit discussion in the r/debtfree community warned, stopping payments can trigger aggressive collection actions that the settlement company can't always prevent.

Here is a video review that provides additional perspective on the service:

It's clear that the outcome is highly dependent on individual circumstances, creditor cooperation, and a client's ability to consistently make their monthly deposits. The best approach is to read both positive and negative reviews to get a balanced understanding of the potential best-case and worst-case scenarios.

Understanding the Legal and Tax Implications

Beyond the impact on your credit, enrolling in a debt settlement program carries significant legal and financial considerations that are often overlooked. These are not minor details; they can have lasting consequences if you're not prepared.

The Risk of Lawsuits from Creditors

When you sign up for debt settlement, you are intentionally breaking the terms of your credit agreements by stopping payments. This gives your creditors the legal right to take action to collect the money they are owed. While many creditors are willing to negotiate a settlement to avoid the hassle and expense of a lawsuit, some may choose to sue you instead.

If a creditor files a lawsuit and wins a judgment against you, they can pursue more aggressive collection methods, such as garnishing your wages or placing a lien on your property. National Debt Relief is not a law firm and cannot provide legal advice or represent you in court. If you are sued, you will need to hire an attorney at your own expense or respond to the lawsuit yourself.

The "Debt Forgiveness" Tax Bomb

Another potential surprise is the tax bill. According to the IRS, if a creditor forgives $600 or more of debt, they are generally required to file a Form 1099-C, Cancellation of Debt, with the IRS and send you a copy. The forgiven amount is typically considered taxable income, meaning you'll have to report it on your tax return and pay taxes on it.

For example, if NDR negotiates a $10,000 credit card balance down to $4,000, you have $6,000 in forgiven debt. This $6,000 could be added to your income for the year, potentially pushing you into a higher tax bracket. There is a key exception: the insolvency exclusion. According to the IRS Publication 4681, if your total liabilities exceeded your total assets immediately before the debt was forgiven, you may not have to include the forgiven debt in your income.

However, navigating this rule can be complex, and consulting with a tax professional is highly recommended.

Pro Tip: If you receive a 1099-C form, don't ignore it. You'll need to file Form 982 with your tax return to claim the insolvency exclusion if you qualify. A tax advisor can help you determine your insolvency status and fill out the paperwork correctly.

The Future of Debt Relief: What's Next for Consumers?

The landscape of personal finance and debt management is constantly evolving. Technology and changing consumer behaviors are shaping the future of debt relief solutions, moving towards more personalized and proactive approaches. While traditional methods like debt settlement will likely remain, new trends are emerging that could provide consumers with more options.

One major trend is the use of artificial intelligence and machine learning in negotiations. Fintech companies are developing algorithms that can analyze a consumer's financial data and predict the optimal settlement offer for a specific creditor, potentially leading to faster and more successful negotiations. This data-driven approach could make the process more efficient and transparent.

There is also a growing emphasis on holistic financial wellness. Instead of just treating the symptom (debt), future solutions will likely focus more on the root cause. This means integrating debt relief with tools for budgeting, saving, and financial education. Services that help you manage your entire financial life, like Personal Capital, are part of this trend, offering a complete picture of your finances to help you avoid debt in the first place.

Finally, expect increased regulatory scrutiny. As the debt relief industry grows, government agencies like the Consumer Financial Protection Bureau (CFPB) are paying closer attention to ensure companies are acting in the best interests of consumers. This could lead to stricter rules around fees, transparency, and marketing practices, ultimately providing better protection for individuals seeking help.

Frequently Asked Questions (FAQ)

What is the downside of national debt relief?

The primary downsides are severe damage to your credit score, which can last for up to seven years; the risk of being sued by your creditors for non-payment; high fees that typically range from 15% to 25% of the debt enrolled; and the possibility that forgiven debt will be considered taxable income by the IRS. There is also no guarantee that all of your creditors will agree to a settlement.

Is national debt relief a legit program?

Yes, National Debt Relief is a legitimate for-profit debt settlement company. It is accredited by the American Association for Debt Resolution (AADR) and holds an A+ rating with the Better Business Bureau. However, its legitimacy as a company does not eliminate the inherent risks associated with the debt settlement process itself.

Does national debt relief hurt your credit?

Yes, absolutely. The program's strategy requires you to stop making payments to your creditors, which results in missed payments, delinquencies, and eventually charge-offs on your credit report. These are all major negative events that will cause a significant drop in your credit score. This damage is a necessary part of the process and should be expected.

Do people get sued using national debt relief?

Yes, it is possible to be sued by a creditor while enrolled in the program. When you stop making payments, you are in breach of your credit agreement, and creditors have the legal right to sue you to collect the debt. While National Debt Relief negotiates to prevent this, they cannot offer legal protection, and the risk of a lawsuit remains throughout the process.

What is the success rate of national debt relief?

National Debt Relief does not publicly advertise a specific success or completion rate. The success of the program depends heavily on a client's ability to make consistent monthly payments into their savings account and the willingness of their specific creditors to negotiate. A client who misses payments or withdraws from the program early will not see their debts settled.

Which is better, Freedom or National Debt Relief?

Both Freedom Debt Relief and National Debt Relief are two of the largest and most reputable companies in the debt settlement industry. They operate on very similar models, and both have thousands of positive and negative reviews. The best choice often comes down to the specifics of their fee structure for your debt amount and which company's representative you feel more comfortable with after a consultation.

Final Verdict: Is National Debt Relief the Right Choice for You?

After a thorough review, it's clear that National Debt Relief offers a legitimate service that can be a powerful tool for the right person in the right situation. However, it is far from a simple or risk-free solution. It is an aggressive financial strategy that trades your credit score for a reduction in your total debt.

The program is best suited for individuals who are truly at a financial breaking point—those with over $7,500 in unsecured debt who are already falling behind on payments and see no other way to manage their obligations. For this group, the damage to their credit may be a worthwhile trade-off for becoming debt-free and avoiding bankruptcy.

Conversely, National Debt Relief is a poor choice for anyone who can still afford their minimum payments, is concerned with preserving their credit score for future goals like buying a home, or has a debt load below the program's minimum. For these individuals, less drastic alternatives like a debt management plan from a non-profit credit counseling agency or a debt consolidation loan are far better options.

If you've weighed the significant pros and cons and believe debt settlement aligns with your financial reality, taking the next step is straightforward. You can get a free, no-obligation consultation from National Debt Relief to see what they can offer. If you're looking to compare options, consider also getting a quote from a competitor like Accredited Debt Relief to ensure you're making the most informed decision possible.