Taking control of your money doesn’t require advanced financial knowledge or complicated tools. Budgeting is simply about understanding where your money goes and making intentional choices that align with your goals. With the right approach, anyone can build a budget that feels manageable and empowering.

Why Budgeting Matters

A budget gives you clarity and control. It helps you avoid overspending, prepare for unexpected expenses, and reduce financial stress. When you know exactly how much money you have and where it’s going, you can make smarter decisions and feel more confident about your finances.

Understanding Your Income and Expenses

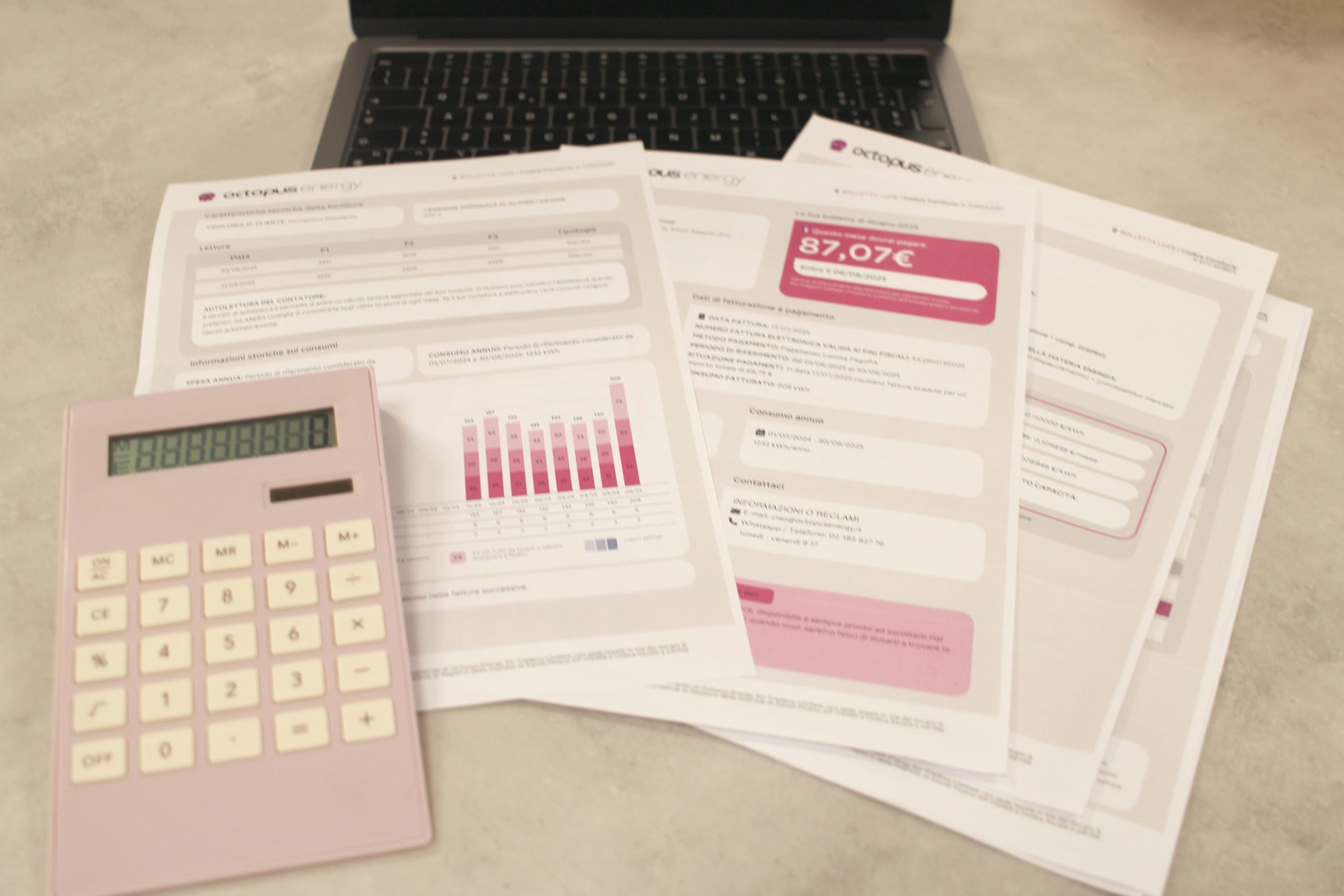

The first step in budgeting is knowing your numbers. Start by calculating your total monthly income after taxes. Next, list all your expenses, including fixed costs like rent and utilities, as well as variable spending such as food, transportation, and entertainment. This overview creates a clear picture of your financial habits.

Setting Clear Financial Goals

Budgeting becomes easier when you have a purpose. Decide what you want your money to do for you, whether that’s building an emergency fund, paying off debt, saving for a trip, or planning for the future. Clear goals give your budget direction and motivation.

Creating a Simple Budget Plan

Choose a budgeting method that fits your lifestyle. Some people prefer percentage-based plans, while others like assigning every dollar a job. The key is simplicity. A budget should be easy to follow and flexible enough to adjust as your life changes.

Tracking Your Spending

Tracking spending helps you stay accountable and identify problem areas. You don’t need to track every cent, but regularly reviewing your expenses ensures you stay within your limits. This habit makes it easier to spot unnecessary spending and redirect money toward your priorities.

Adjusting and Improving Over Time

Your first budget doesn’t have to be perfect. Life changes, and your budget should change with it. Review your plan regularly and make adjustments as needed. Each month is an opportunity to learn, improve, and get closer to your financial goals.

Building Consistency and Confidence

Budgeting is a skill that improves with practice. As you stay consistent, you’ll gain confidence in managing your money and feel more in control of your financial future. Small steps taken today can lead to lasting financial stability and peace of mind.