7 Best Personal Finance and Budgeting Apps for 2025 (To Master Your Money)

Managing your money can feel overwhelming. Between bills, savings goals, investments, and daily spending, keeping track of where every dollar goes is a significant challenge. Using the right personal finance and budgeting apps can transform this complexity into clarity, giving you a complete picture of your financial health right on your phone.

These powerful tools automate the tedious parts of money management, like tracking expenses and categorizing spending, so you can focus on making smarter financial decisions. Whether you want to aggressively pay down debt, save for a down payment, or simply stop living paycheck to paycheck, there's an app designed to help you succeed.

This guide breaks down the best finance management apps available in 2025. We'll compare their features, pricing, and ideal user so you can find the perfect tool to take control of your money and build a more secure financial future.

What to Know

- Clarity is Key: The primary benefit of budgeting apps is gaining a clear, real-time view of your income, expenses, and savings, which helps you identify spending patterns and find opportunities to save.

- Essential Features: Look for apps with secure bank account integration, customizable budget categories, goal tracking, and bill reminders. The best apps offer a combination of these to provide a holistic financial overview.

- No One-Size-Fits-All: The best app for you depends on your personality and goals. Hands-on budgeters may prefer YNAB's detailed methodology, while those seeking automation might lean toward Rocket Money for its subscription management.

- Security is Paramount: Reputable personal finance apps use bank-level security, including 256-bit encryption and multi-factor authentication, to protect your sensitive data. They typically have read-only access to your accounts.

Why Use Personal Finance and Budgeting Apps?

In a world of automatic payments, subscriptions, and tap-to-pay transactions, it's easier than ever to lose track of your spending. Personal finance apps act as your financial command center, bringing all your accounts into one place to give you a clear and accurate picture of your financial life. The core benefit is moving from a reactive to a proactive relationship with your money.

Instead of wondering where your money went at the end of the month, these tools show you in real-time. This visibility is the first step toward meaningful change. You can spot wasteful subscriptions you forgot about, identify categories where you consistently overspend, and see how much you're truly saving toward your goals. This data-driven approach removes the guesswork from budgeting.

Beyond just tracking, these apps reduce financial stress. Automated bill reminders prevent late fees, and goal-setting features provide motivation by visualizing your progress. By automating the tedious work of categorizing transactions, they free up your mental energy to focus on the bigger picture, like planning for retirement or saving for a major purchase. Ultimately, using a budgeting app is about gaining control, building confidence, and creating a clear path to achieving your financial goals.

The 7 Best Personal Finance and Budgeting Apps of 2025

After extensive research and comparison, here are the top personal finance apps that stand out for their features, user experience, and effectiveness in helping you manage your money.

1. YNAB (You Need A Budget): Best for Hands-On Budgeters

-521674f8-2d6f-4c9b-83c3-7f4719326ac9-1765616725736-yrxxa4.png)

YNAB (You Need A Budget) is more than just an app; it's a complete financial methodology. Built on the principle of zero-based budgeting, YNAB requires you to "give every dollar a job." This proactive approach forces you to be intentional with your money, allocating funds to expenses, debt payments, and savings goals before you spend it.

It's designed for users who want to be deeply involved in their finances. The app has a bit of a learning curve, but YNAB provides extensive educational resources, including live workshops and video tutorials, to help you master its four rules. It's incredibly effective for breaking the paycheck-to-paycheck cycle and gaining total control over your cash flow.

While it comes with a subscription fee, many dedicated users report saving far more than the app's cost within the first few months. Its focus on planning ahead rather than just tracking past spending makes it a powerful tool for anyone serious about changing their financial habits.

Pros

- Effective Methodology: The zero-based budgeting system is proven to help users save money and pay off debt.

- Excellent Educational Support: Offers free workshops, videos, and guides to help you succeed.

- Goal-Oriented: Strong features for setting and tracking savings and debt payoff goals.

Cons

- Requires Active Management: This is not a "set it and forget it" app; it requires regular engagement.

- Subscription Cost: There is no free version, which may be a barrier for some.

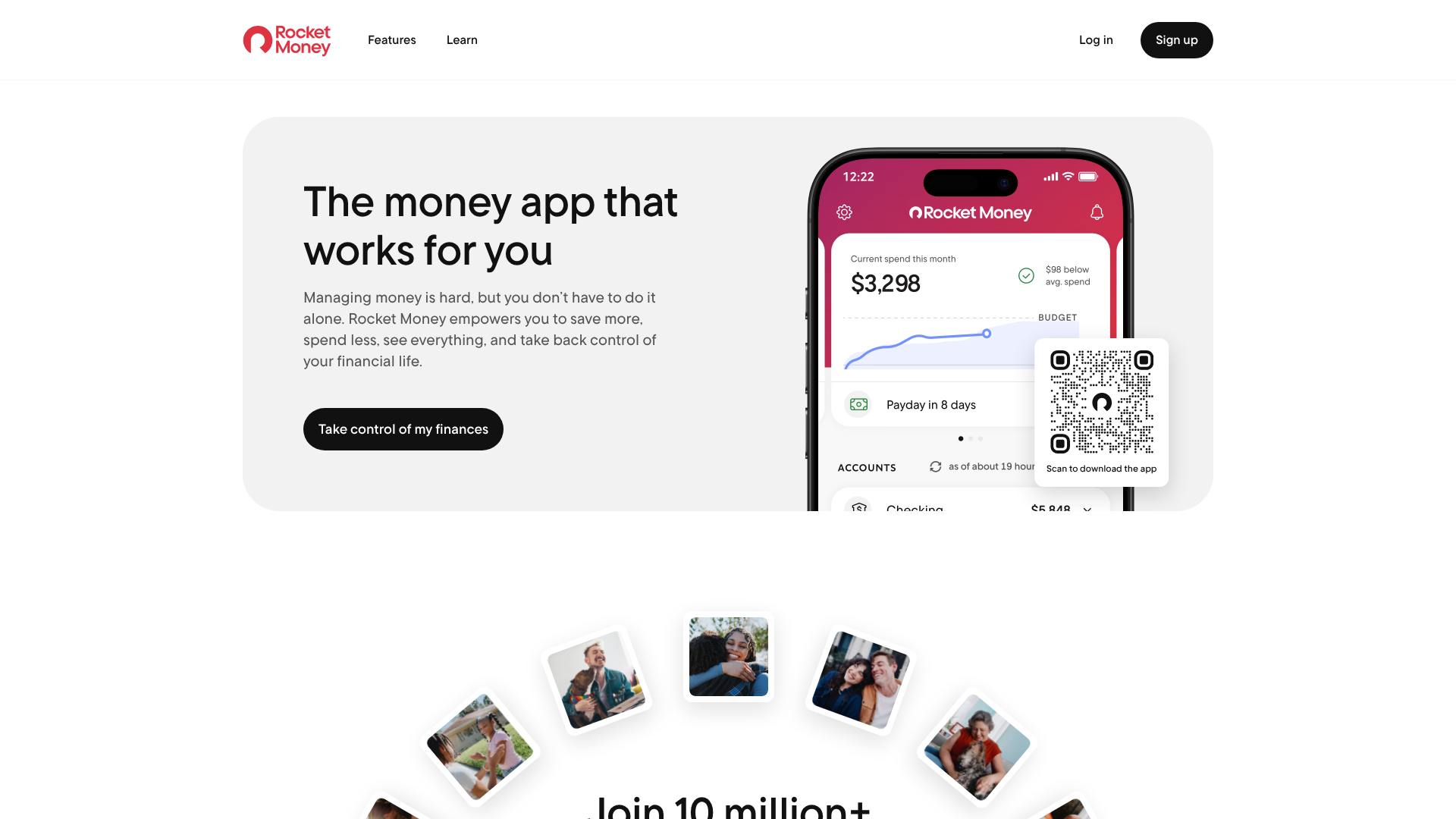

2. Rocket Money: Best for Managing Subscriptions and Bills

Rocket Money (formerly Truebill) excels at automating your financial life and finding hidden savings. Its standout feature is its ability to scan your accounts for recurring subscriptions and help you cancel unwanted ones with a single tap. For many users, this feature alone can save hundreds of dollars a year.

Beyond subscription management, Rocket Money offers robust budgeting tools, automated savings, and bill negotiation services. The app analyzes your spending and income to create a budget and alerts you to upcoming bills to avoid overdrafts. It's an excellent choice for users who want a more automated, hands-off approach to their finances.

The free version provides basic budgeting and subscription tracking, while the premium subscription unlocks features like automated cancellations, credit score monitoring, and the bill negotiation service. If you feel like your subscriptions are out of control, Rocket Money is one of the best finance management apps to get them in check.

Pros

- Subscription Cancellation: Easily identifies and cancels unwanted recurring charges.

- Automated Features: Helps automate savings and provides smart spending insights.

- Bill Negotiation: The premium service can negotiate lower rates on bills like cable and internet on your behalf.

Cons

- Some Key Features are Premium: The most powerful tools, like automated cancellation, require a paid subscription.

- Focus is on Automation: May not be ideal for users who prefer manual, hands-on budgeting.

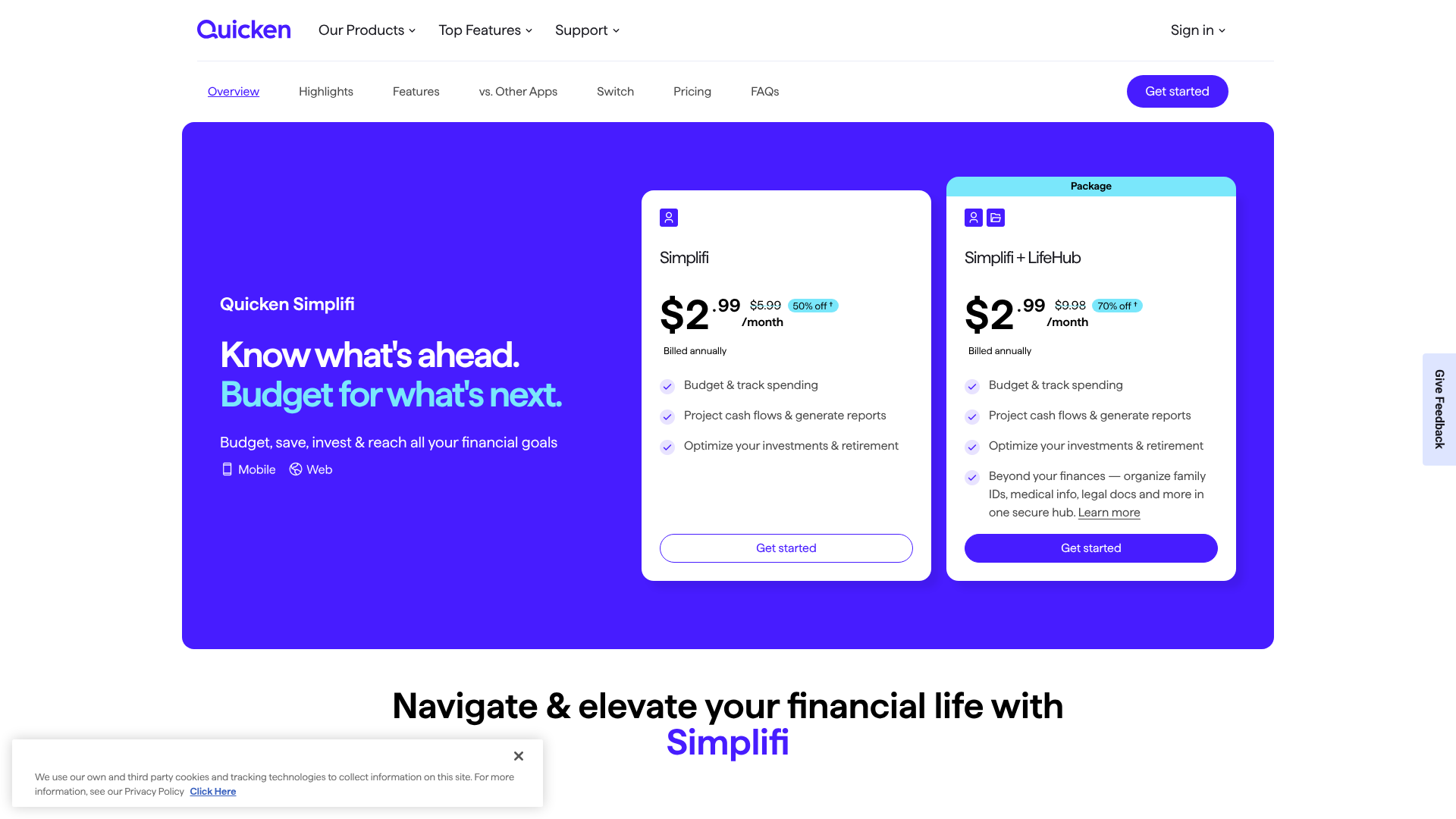

3. Quicken Simplifi: Best All-in-One Money Management

From the makers of the legendary Quicken software, Quicken Simplifi is a modern, mobile-first app designed for a comprehensive view of your finances. It connects all your accounts—checking, savings, credit cards, loans, and investments—to give you a real-time snapshot of your net worth.

Simplifi's strength lies in its powerful cash flow projections and custom spending plans. It automatically categorizes your transactions and creates a simple budget based on your income and recurring bills, showing you exactly how much you have left to spend. It also offers dedicated watchlists for specific spending categories and savings goals.

This app is great for those who want more than just a budget. With its investment tracking and net worth reporting, it serves as a complete financial dashboard. It’s a strong contender for former Mint users looking for a powerful, ad-free alternative.

Pros

- Comprehensive Financial Overview: Tracks spending, savings, investments, and net worth in one place.

- Powerful Reporting: Offers detailed cash flow projections and spending reports.

- Ad-Free Experience: A clean user interface without distracting ads.

Cons

- Subscription-Based: No free version is available after the trial period.

- Can Be Overwhelming: The amount of data might be too much for absolute beginners.

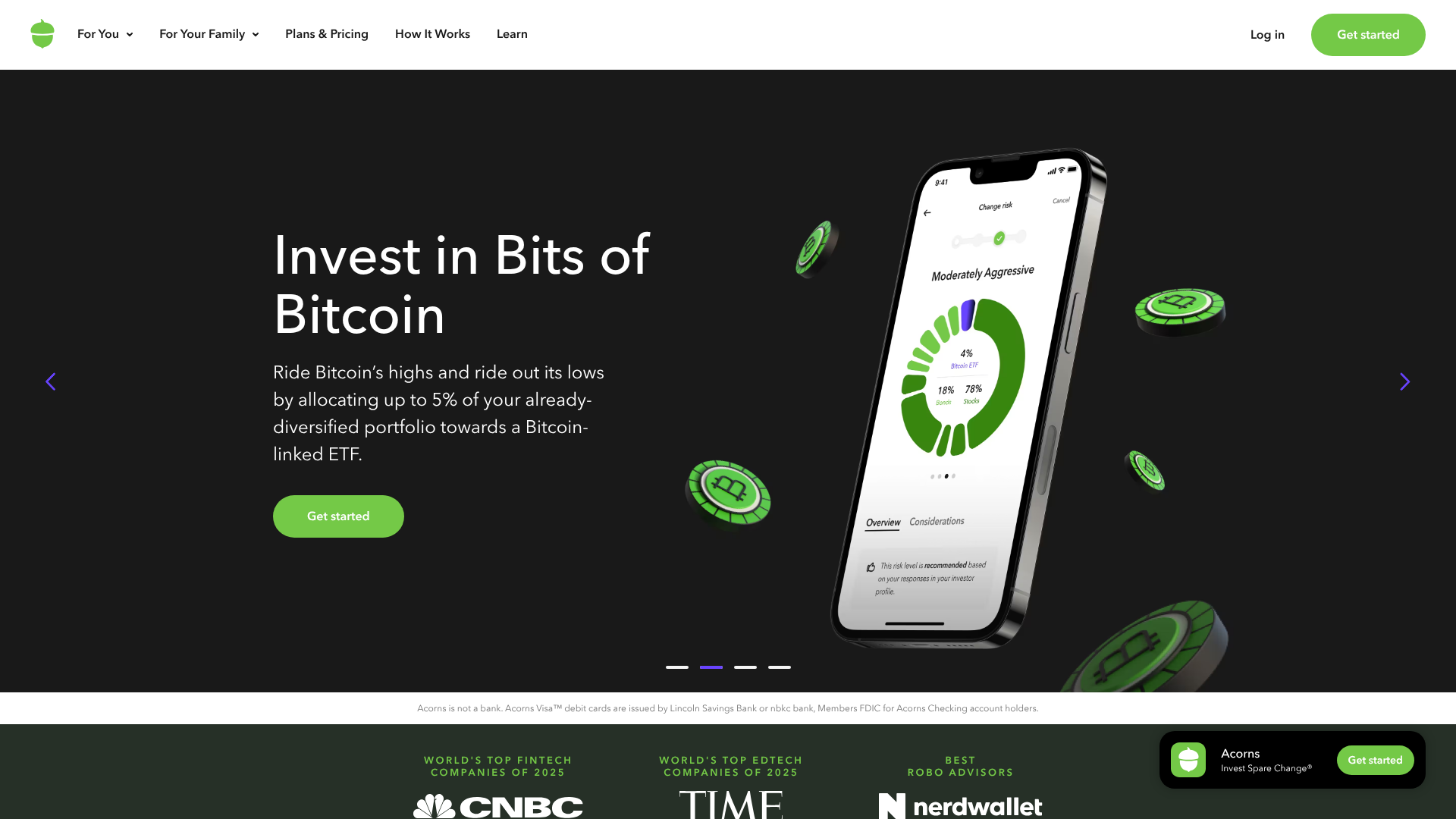

4. Acorns: Best for Effortless Investing and Saving

Acorns is a unique app that blends saving, investing, and spending. Its most famous feature is "Round-Ups," which automatically rounds up your purchases to the nearest dollar and invests the spare change into a diversified portfolio of ETFs. This makes investing accessible and effortless, especially for beginners.

While not a traditional budgeting app, Acorns encourages positive financial habits by making saving and investing an automatic part of your daily spending. You can also set up recurring investments to build your portfolio faster. The platform also offers retirement accounts (Acorns Later) and a checking account (Acorns Checking) that integrates with its investing features.

Acorns is perfect for individuals who are new to investing or struggle to save consistently. It automates the entire process, allowing you to build wealth in the background without having to think about it. It’s a fantastic tool for turning small change into a significant nest egg over time.

Pros

- Automated Micro-Investing: The Round-Ups feature makes it easy to start investing with spare change.

- User-Friendly: Simple and intuitive interface, perfect for beginners.

- All-in-One Platform: Offers investment, retirement, and checking accounts.

Cons

- Management Fees: The monthly subscription fee can be high for very small account balances.

- Limited Investment Control: You can't choose individual stocks; you invest in pre-built portfolios.

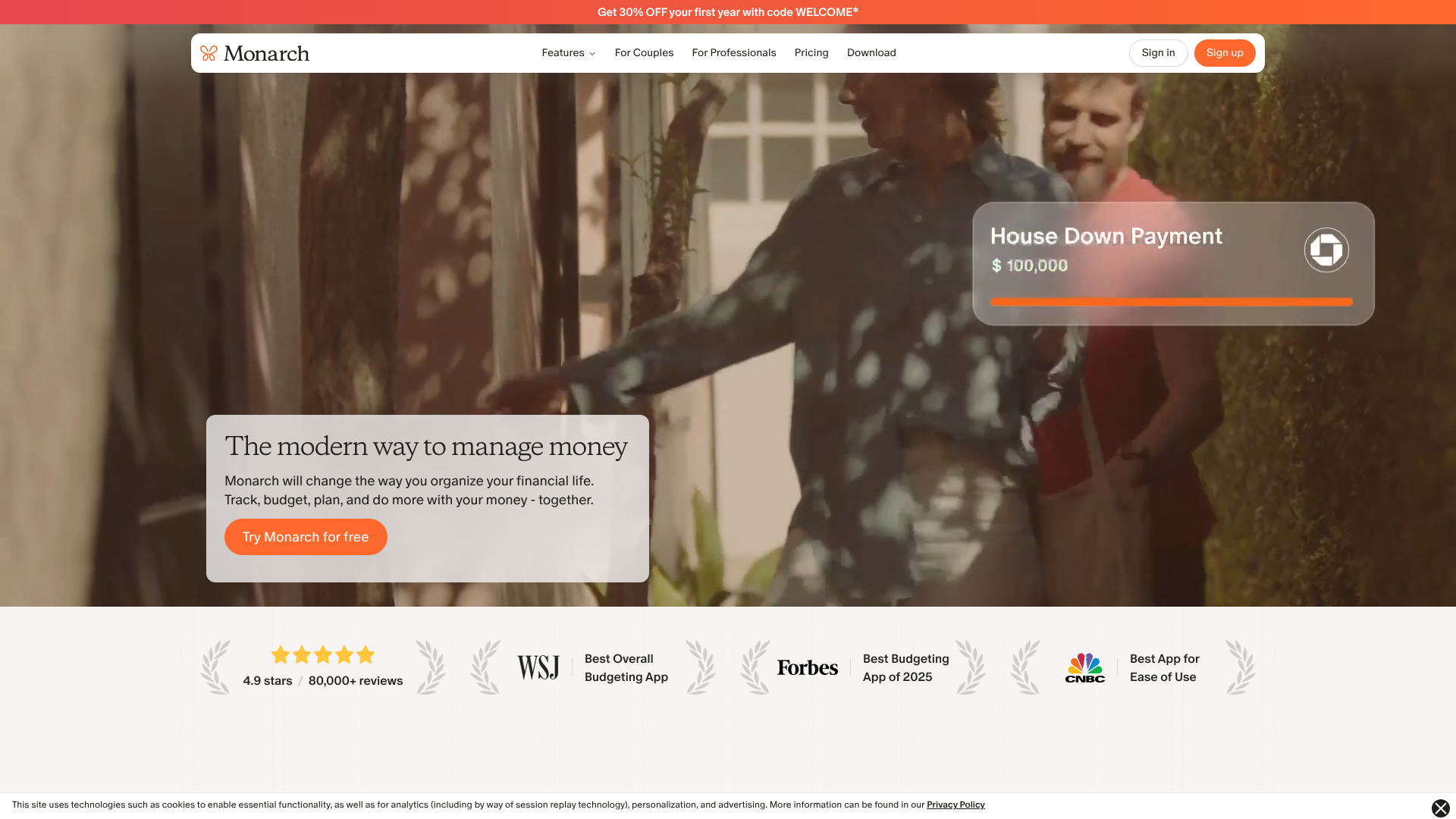

5. Monarch Money: Best for Couples and Goal Planning

Monarch Money has quickly become a favorite, especially for couples and families looking to manage their finances together. It allows you to invite a partner to your financial dashboard, where you can both view accounts, track a shared budget, and work toward common goals. Each user can maintain their own personal view while contributing to the household's financial picture.

Beyond its collaborative features, Monarch offers a clean, modern interface with highly customizable dashboards. You can track everything from your monthly budget to your investments and net worth. Its goal-setting feature is particularly robust, allowing you to plan for large goals like a home purchase or retirement and see how your current habits impact your timeline.

Monarch Money is another excellent premium alternative for those who were disappointed by the shutdown of Mint. It offers a powerful, ad-free experience focused on providing a complete and collaborative view of your wealth.

Pros

- Excellent for Collaboration: Designed for couples and families to manage finances jointly.

- Highly Customizable: The dashboard and widgets can be tailored to your preferences.

- Holistic Financial View: Tracks net worth, investments, and transactions seamlessly.

Cons

- Premium Price Tag: It is one of the more expensive subscription-based apps.

- Can Have Syncing Issues: Some users report occasional issues with connecting to smaller financial institutions.

6. Goodbudget: Best for the Envelope Budgeting Method

Goodbudget brings the classic envelope budgeting system into the digital age. This method involves allocating your income into different spending categories (or "envelopes") at the beginning of the month. As you spend, you deduct the amount from the corresponding envelope, which helps prevent overspending.

This app is ideal for those who prefer a more manual, hands-on approach. While you can sync bank accounts, the core philosophy encourages you to actively track your spending against your planned envelopes. It's a great tool for couples and families, as it allows you to share a budget and sync envelopes across multiple devices.

Goodbudget offers a generous free version that includes 10 regular envelopes, which is often enough for individuals or couples to get started. The paid version offers unlimited envelopes, more devices, and longer transaction history. If you like the tangible feel of the envelope system, Goodbudget is the best digital translation of it.

Pros

- Proven Budgeting Method: The envelope system is a time-tested way to control spending.

- Great for Sharing: Easily syncs budgets between partners and family members.

- Generous Free Version: The free plan is functional and sufficient for many users.

Cons

- Requires Manual Input: Less automated than other apps, which can be time-consuming.

- No Investment Tracking: Strictly focused on budgeting and expense tracking.

7. Moneyspire: Best for Desktop-Focused Users

While many apps are mobile-first, Moneyspire offers a powerful desktop experience for users who prefer to manage their finances on a computer. It's a comprehensive personal finance software that helps you organize transactions, manage accounts, track bills, and maintain a budget. It also offers a mobile companion app to record transactions on the go.

Moneyspire supports online banking and direct connect with thousands of banks, but it also works completely offline for users who prioritize privacy and prefer to enter data manually. Its reporting features are extensive, allowing you to generate detailed reports on your spending, net worth, and budget performance.

Instead of a subscription, Moneyspire is sold as a one-time purchase, which may appeal to users tired of recurring fees. It's a solid choice for those who want a traditional, robust desktop application with modern syncing capabilities.

Pros

- One-Time Purchase: No recurring monthly or annual fees.

- Works Offline: You can manage your finances without connecting to the internet.

- Robust Reporting: Create detailed and customizable financial reports.

Cons

- Desktop-First Interface: The mobile app is less feature-rich than the desktop software.

- Dated User Interface: The design may feel less modern compared to mobile-first apps.

Feature Comparison of Top Finance Management Apps

Choosing the right tool can be easier when you see the features side-by-side. Here’s a quick comparison of our top picks to help you decide.

| Feature | YNAB | Rocket Money | Quicken Simplifi | Monarch Money |

|---|---|---|---|---|

| Best For | Hands-On Budgeting | Subscription Management | All-in-One View | Couples & Goals |

| Budgeting Method | Zero-Based | Automated/Traditional | Spending Plan | Traditional/Custom |

| Bank Sync | Yes | Yes | Yes | Yes |

| Investment Tracking | No | Yes (Premium) | Yes | Yes |

| Bill Management | Yes (via goals) | Yes (Negotiation) | Yes (Reminders) | Yes (Reminders) |

| Pricing Model | Subscription | Freemium | Subscription | Subscription |

How to Choose the Right Budgeting App for You

With so many options, selecting the perfect personal finance app comes down to your individual needs and habits. The best app is the one you'll consistently use. Consider these factors to make your decision.

First, think about your budgeting personality. Are you a hands-on person who enjoys digging into the details? If so, a methodological app like YNAB (You Need A Budget) might be a great fit. If you prefer a more automated, set-it-and-forget-it approach, an app like Rocket Money that tracks spending and subscriptions in the background could be better.

Second, evaluate the cost. Many powerful apps require a subscription. While free apps exist, they often come with advertisements or limited features. Consider the subscription fee as an investment in your financial health.

If an app that costs $99 a year helps you save $500, it's a worthwhile expense. Many offer free trials, so you can test them out before committing.

Finally, identify your primary goal. Are you focused on paying off debt. Look for an app with strong debt-payoff planners. Do you want to start investing.

An app like Acorns is designed for that. Are you managing finances with a partner. Prioritize an app with collaborative features like Monarch Money. Matching the app's strengths to your financial goals is the key to long-term success.

The Critical Importance of Security and Privacy

Handing over your financial data to an app can feel daunting, which is why security and privacy are paramount. Reputable finance management apps invest heavily in protecting your information, often using the same security protocols as major banks. Understanding how they work can provide peace of mind.

Most apps connect to your bank accounts using a third-party aggregator service like Plaid or Finicity. These services act as a secure bridge, tokenizing your login credentials so the app itself never stores your username or password. The connection is typically "read-only," meaning the app can see your transaction data but cannot move money or make changes to your accounts.

When choosing an app, look for key security features. Bank-level 256-bit AES encryption is the industry standard for protecting data both in transit and at rest. Multi-factor authentication (MFA) adds another critical layer of security, requiring a second form of verification to access your account. Always review an app's privacy policy to understand how your data is used and whether it's sold to third parties.

A trustworthy app will be transparent about its security practices.

Pro Tip: Before linking your accounts, enable multi-factor authentication on both the budgeting app and your bank accounts. This is one of the most effective steps you can take to secure your financial data against unauthorized access.

Setting and Achieving Financial Goals with Your App

One of the most powerful features of modern budgeting apps is their ability to help you set, track, and achieve your financial goals. Moving beyond simple expense tracking, these tools turn abstract dreams like "buy a house" or "retire early" into concrete, actionable plans.

The process usually starts by creating a specific goal within the app. For example, you can set a goal to save $10,000 for a down payment on a car by a specific date. The app will then calculate how much you need to save each month to stay on track. This transforms a large, intimidating number into manageable monthly targets.

As you contribute to your goal, the app provides visual feedback, such as a progress bar that fills up over time. This constant reinforcement is highly motivating and helps you stay focused. Many apps also allow you to link specific savings accounts to your goals, making it easy to see your dedicated funds grow. By breaking down large ambitions into smaller steps and celebrating your progress, these apps make it significantly easier to turn your financial goals into reality.

Tips for Effective Budgeting with Apps

Simply downloading a budgeting app isn't enough; success depends on how you use it. To get the most out of your chosen tool, it's important to build consistent habits. These tips will help you stay on track and make your budgeting efforts effective.

First, commit to a regular check-in. Spend 5-10 minutes each day or every other day reviewing and categorizing new transactions. This prevents a backlog of uncategorized spending and keeps you constantly aware of your financial status. A quick daily check-in is far less intimidating than a massive reconciliation session at the end of the month.

Second, customize your budget categories. The default categories may not perfectly match your lifestyle. Create categories that reflect your actual spending habits. For example, instead of a generic "Shopping" category, you might create separate ones for "Clothing," "Household Goods," and "Hobbies." This granularity provides deeper insight into where your money is truly going.

Finally, be flexible and forgive yourself. No budget is perfect, and life is unpredictable. You will have months where you overspend in certain categories. Instead of getting discouraged, use it as a learning opportunity.

Adjust your budget for the next month and move on. The goal is progress, not perfection.

Common Mistakes to Avoid in Personal Finance Management

While personal finance apps are powerful tools, they can't protect you from common behavioral mistakes. Being aware of these pitfalls is the first step to avoiding them on your journey to financial wellness.

One of the most frequent errors is creating an unrealistic budget. If you're used to spending $600 a month on dining out, slashing that category to $100 overnight is a recipe for failure. Start with small, sustainable changes. Track your spending for a month to get a realistic baseline, then identify areas where you can reasonably cut back.

Another common mistake is the "set it and forget it" approach. A budget is a living document, not a one-time setup. Your income, expenses, and priorities will change over time. You must review and adjust your budget regularly, at least once a month, to ensure it still aligns with your life and goals.

Lastly, many people neglect to budget for irregular expenses, like annual insurance premiums, holiday gifts, or car repairs. These predictable but infrequent costs can derail your budget if you're not prepared. Use your app to create dedicated savings goals or "sinking funds" for these expenses, setting aside a small amount each month so the money is there when you need it.

The Future of Personal Finance Technology

Personal finance technology is constantly evolving, with new innovations poised to make managing money even more intuitive and personalized. The future of budgeting apps is moving beyond simple tracking and toward becoming true AI-powered financial assistants.

Artificial intelligence and machine learning are at the forefront of this shift. Future apps will offer hyper-personalized insights and predictive advice. For example, an app might analyze your spending habits and warn you that you're on track to overspend in your grocery category this month, or it could suggest a better savings account based on your goals and current interest rates.

Open banking, which allows for secure data sharing between financial institutions, will enable even deeper integration. Imagine an app that can not only track your budget but also seamlessly move money between accounts to optimize interest earnings or automatically pay down high-interest debt. Gamification is another growing trend, with apps like Long Game using prize-linked savings to make building good financial habits more engaging and fun. These advancements will continue to lower the barrier to effective financial management for everyone.

Real Success Stories: How Budgeting Apps Change Lives

Behind the data and features are real people whose lives have been transformed by taking control of their finances. These stories highlight the tangible impact that using a budgeting app can have.

Consider "Jenna," a marketing professional who was struggling with over $20,000 in credit card debt. She felt like she was making good money but had nothing to show for it. After starting with YNAB, she meticulously tracked her spending and used the debt payoff planner. By giving every dollar a job, she found hundreds in extra cash flow each month to put toward her debt.

In just under two years, she became completely debt-free.

Then there's "The Millers," a couple saving for their first home. They felt their goal was impossibly far away. Using Monarch Money, they synced all their accounts and created a shared "Down Payment" goal. The app's clear visuals and progress tracking kept them motivated.

They identified areas to cut back, like subscriptions and frequent takeout, and automated their savings. They reached their savings goal six months ahead of schedule and are now proud homeowners. These stories show that with the right tool and commitment, significant financial change is possible.

FAQ: Your Questions About Personal Finance Apps Answered

What is the best personal finance budgeting software?

There is no single "best" software for everyone, as the ideal choice depends on your personal financial goals and habits. For hands-on budgeters who want to change their habits, YNAB is often considered the gold standard. For those who want automation and help managing subscriptions, Rocket Money is a top choice. For an all-in-one view that includes investments, Quicken Simplifi or Monarch Money are excellent options.

What is the 50/30/20 rule budget?

The 50/30/20 rule is a popular budgeting guideline that allocates your after-tax income into three categories. 50% goes toward "Needs" (housing, utilities, transportation), 30% goes toward "Wants" (dining out, hobbies, entertainment), and 20% goes toward "Savings and Debt Repayment." Many budgeting apps allow you to categorize your spending to see how well you align with this rule.

Which budgeting app does Dave Ramsey recommend?

Dave Ramsey recommends the EveryDollar app, which is built around his zero-based budgeting philosophy—the same principle that powers YNAB. In a zero-based budget, your income minus your expenses equals zero. This means you assign a purpose to every single dollar you earn, ensuring nothing is wasted.

Why did Mint shut down?

Intuit, the company that owned Mint, decided to shut it down in early 2024 and encourage users to migrate to its other platform, Credit Karma. While Credit Karma offers some financial tracking features, it lacks the detailed budgeting and reporting tools that made Mint popular. This shutdown created a significant opportunity for other personal finance apps like Quicken Simplifi, Monarch Money, and YNAB to attract former Mint users looking for a powerful alternative.

What is the best finance app for beginners?

For absolute beginners, an app with a simple interface and a high degree of automation is often best. Rocket Money is a great starting point because it automates much of the tracking process and provides clear insights without being overwhelming. Acorns is also excellent for beginners who want to start saving and investing without a steep learning curve, thanks to its automated Round-Ups feature.

Final Thoughts: Taking Control of Your Financial Future

Choosing to actively manage your money is one of the most empowering decisions you can make. The right personal finance and budgeting app serves as your trusted co-pilot on this journey, providing the clarity, tools, and motivation you need to navigate your financial life with confidence.

Remember that the features and technology are only part of the equation. The most important factor is consistency. The best app is the one that clicks with your personality and that you are willing to engage with regularly. Whether you prefer the detailed methodology of YNAB or the effortless automation of Rocket Money, the goal is the same: to build a better financial future.

If you're ready to get started, consider trying out a few options with free trials to see which one fits best. If you're looking for a structured plan to change your habits, YNAB (You Need A Budget) offers a powerful framework. If you'd rather find savings automatically, Rocket Money could be the perfect fit. The first step is choosing a tool and beginning the journey to financial control.